Current EB-5 Project

Civitas Hawaii Fund, LP

Rural EB-5 Investment Opportunity

Project Summary

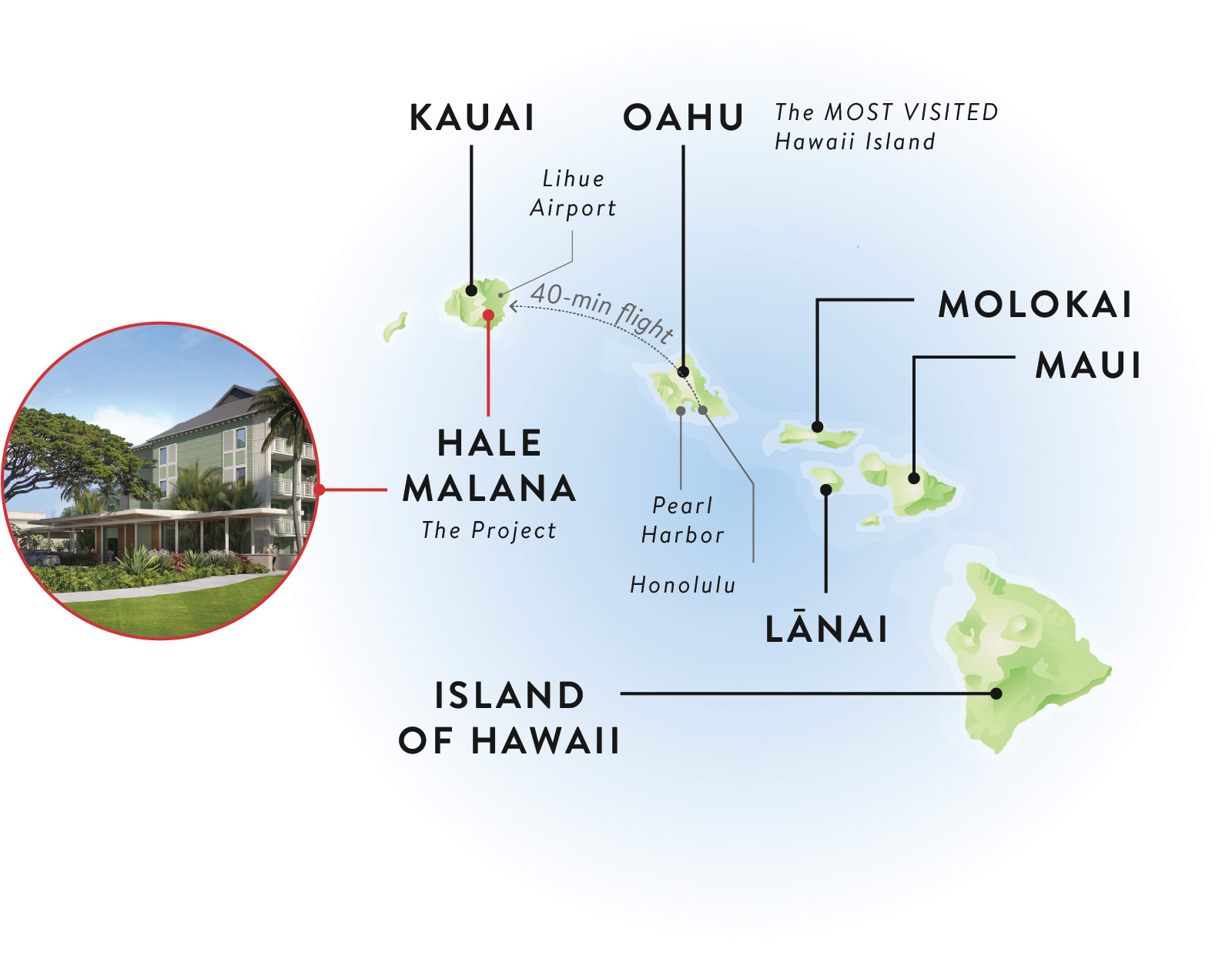

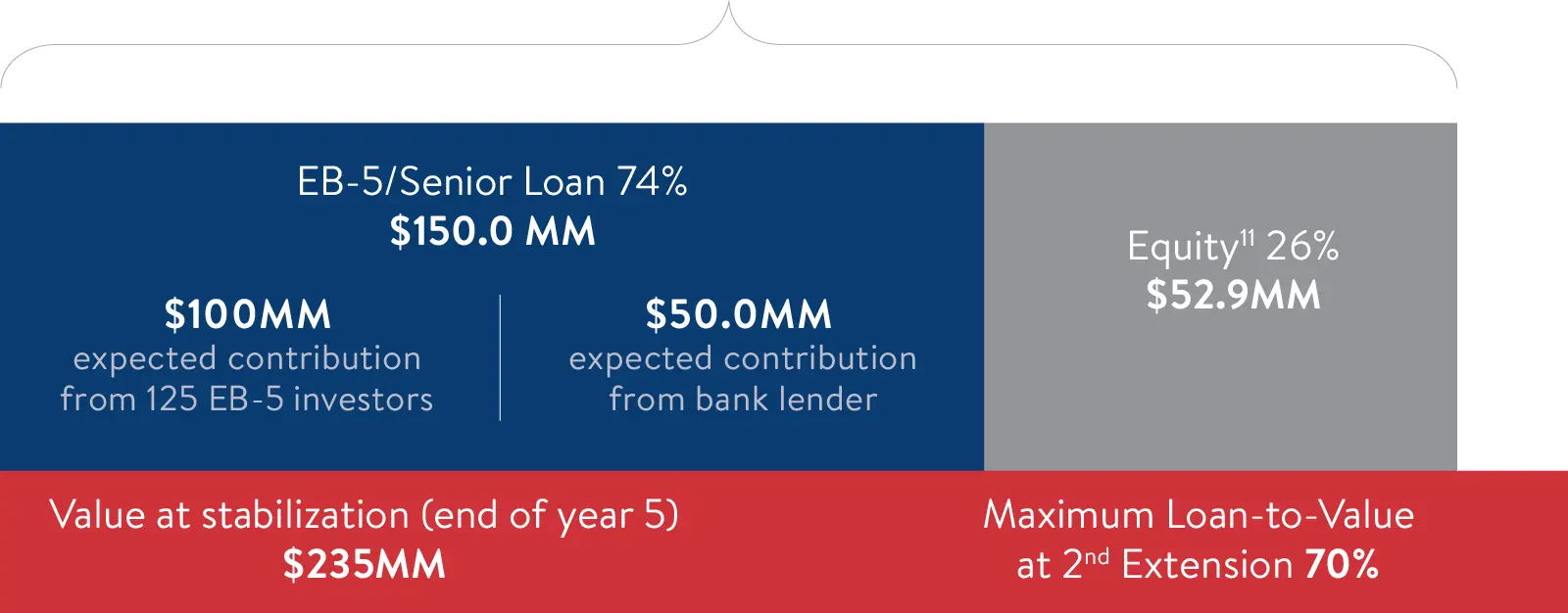

Civitas Hawaii Fund, LP, will provide a $150.0 million senior loan to finance a 210-room hotel, Hale Malana, a Curio Collection1 by Hilton Hotels & Resorts, located in Kauai, Hawaii.

Hale Malana will include a three-meal restaurant, a pool, 2,000 square feet of indoor meeting space, 25,000 square feet of outdoor event venues, a fitness center, and the pro shop for the 18-hole Jack Nicklaus Ocean Course at Hokuala.

Upon opening, Hale Malana would only be the third Hilton-branded hotel on the island.

June 2028

target senior loan

repayment date2

A rural TEA

qualified investment

making EB-5 investors

eligible for priority

processing

125 EB-5 investors

or $100M in total EB-5

funding in the senior

loan position3

Civitas EB-5 Track Record4

100%

EB-5 project approval rate

I-829 approval rate2

40+

countries from which

institutions and investors served

47

EB-5 funds

1,000+

I-526 approvals

$700MM+

in EB-5 capital deployed

$400MM+

capital returned to

investors to date

4. As of December 31, 2023. The 100% USCIS approval rate for Civitas-affiliated I-829 petitions referenced herein refers to petitions which USCIS has fully adjudicated as of the date hereof, and accordingly does not include petitions which (i) have not yet been adjudicated; (ii) were voluntarily withdrawn or abandoned by the petitioner; or (iii) are in any stage of appeal from an initial adjudication. The success of Civitas-affiliated petitions adjudicated to date does not guarantee success in future cases. Past performance is not necessarily indicative of future results. Actual results may vary. This document is provided on a confidential basis and does not constitute an offer or recommendation to sell, or solicitation of an offer to buy, any securities, investment products, or investment advisory services. Such an offer may only be made to qualified investors via delivery of a formal confidential private placement memorandum or equivalent materials that describe the material terms.

Project Location

Hawaii Tourism by the Numbers

9.6MM

visitors to Hawaii in 2023, up 4.4% from 20225

1.4MM

visitors on Kauai in 2023, up 5.3% from 20225

All-time high

In Kauai average daily rate (ADR) and revenue per available room (RevPAR)6

$20.8B

in visitor expenditures in 2023 compared to $19.7B in 20225

$2.8B

in visitor expenditures in 2023 compared to $2.2B in 20225

74.6%

occupancy rate in Kauai in 2023, returning to above pre-pandemic levels6

Major Investors

The Senior loan will be provided to a subsidiary of the project sponsor, Silverwest Hawaii Holdings, LLC, which is owned by two of the largest real estate investment managers in the world, each with over $1 trillion in gross assets under management.

Investor 1

Investor 1 is a well-known global investor in the secondary private equity market, with more than 2,000 transactions reflecting over 5,000 limited partnership interests.

Founded in 2000 and headquartered in New York, the firm has more than $80B in assets under management (AUM). Investor 1 executes strategies across real estate, private equity, and infrastructure investments.

It has offices in over 20 cities across the Americas, Europe, and Asia. Its parent company is one of the world’s largest alternative investment management firms, with more than $1 trillion in AUM.

Investor 2

Investor 2 is a large American Fortune 100 financial services firm with more than 150 years of experience, headquartered in New York. The firm counts investment banking, investment management, and commercial lending among its core functions.

As of 2023 it has an AUM of well over $2 trillion. With more than 50,000 employees, Investor 2 maintains dozens of offices worldwide, operating in the Americas, Asia, Europe, the Middle East, and Africa. The firm serves both public and private sector clients, ranging from institutional corporations to local government entities. This includes companies that raise capital and funding for a variety of investments and services.

All Financing for the Project is Fully in Place

Total Projected Project Cost $202.9MM10

Job Creation12

2,170

expected jobs to

be created

151%

of job requirement

expected to be satisfied

117%

of requirement expected to

be satisfied by construction

phase

12. Job creation estimates are calculated by an independent, third-party econometric consultant using RIMS II, Regional Input-Output Modeling System. RIMS II is a tool provided by the Bureau of Economic Analysis (BEA) to help economists and researchers analyze the potential impacts of economic activities on regional economies. There is no guarantee job creation projections will be achieved. These percentages are calculated based on 125 investors, or $100M in EB-5 investments. The General Partner has discretion to raise an additional $50MM and anticipates considering pursuit of such additional fundraising after the project has been completed. If additional investors are closed into the fund, the job creation and cushion metrics will change.

Project Timeline13

2024

Construction

started in Q3

2026

Q3 target

construction

completion

2027

Ongoing operations

2028

Initial loan maturity

13. Project timeline is subject to change.

Project Location Demand Drivers:

1. The Curio Collection by Hilton is a global portfolio of remarkable, upscale hotels and resorts handpicked for their unique character and personality. 2. Subject to two, 12-month extension options. 3. General Partner has discretion to increase the total EB-funding to $120M, or 150 investors. 5. State of Hawaii, Department of Business, Economic Development & Tourism, Research and Economic Analysis Division, "December 2023 Marked the Fifth Consecutive Month with Declining Visitor Expenditures" January 30, 2024. 6. Hawaii Tourism Authority, as of December 2023. 10. Capital structure and amounts are current estimates and are subject to change. 11. Up to 20% of equity may include contributions from the hotel management company or other sources not directly affiliated with sponsorship group.

This document is provided on a confidential basis and does not constitute an offer or recommendation to sell, or solicitation of an offer to buy, any securities, investment products, or investment advisory services. Such an offer may only be made to qualified investors via delivery of a formal confidential private placement memorandum or equivalent materials that describe the material terms.

Are you a Good Fit for the EB-5 Program?

Schedule a free consultation with our team of EB-5 investment experts today. If you prefer, we will gladly invite you to our downtown Dallas office for an in-person consultation.

Learn About Your EB-5 Eligibility

Schedule a free consultation by filling out the form below and answering the questions below. We will assess if you are a good candidate and will guide you through the EB-5 process.